Are you a small business owner who’s still trying to wrap your head around GST? It can be a minefield, overwhelming and time-consuming. Although you didn’t get into business to wrestle with tax and numbers, you’re aware it’s vital to have a good grasp of how it all works to ensure your tax obligations are met and your books are accurate. In this article, we’ll cover the basics of GST to boost your understanding and help you alleviate the extra stress you don’t need!

What is GST?

GST (known as, Goods and Services Tax) is a 15% tax added to the price of most goods and services sold by businesses. The majority of your purchases will have GST added to the price, with a few exceptions (e.g. rent on a house, airfares for overseas travel or mortgage payments).

If you’re a business owner selling goods or services, you’ll likely charge GST on top of your prices. You’ll then be able to claim the GST back on your expenses with IRD (GST returns) – which is often done bi-monthly or six-monthly for small business owners.

Registering for GST and the different scenarios

If you’re starting up or running a business – or perhaps you want to give sole trading a go, here’s a quick summary of registering for GST in NZ.

You DO need to register for GST if:

- You’re earning over $60,000 per year

- You carry out taxable activity and your turnover is at least $60,000 in the last 12 months

- You expect it will be at least $60,000 in the next 12 months

- You carry out taxable activity and you add GST to the price of your goods or services you sell

TIP: Taxable activity means any activity that supplies goods or services to someone else for money, compensation, reward or profit.

You DO NOT need to register for GST if:

- If you’re a sole trader, you can use the same GST number as your IRD number – so there’s no need to register for a new business one unless you form a new company

- You’re earning under $60,000 per year

TIP: You could consider registering for GST if You want to claim back GST on a large asset purchase and most of your sales are to overseas entities.

Pros and cons of registering for GST include

There are both advantages and disadvantages to registering for GST as a small business in NZ.

The pros include:

- It helps you stay on top of your paperwork and demonstrates how your business is doing

- You can claim on your business expenses relating to your taxable activity

- It makes it easier to deal with your suppliers

The cons include:

- Adding GST to your fees

- Extra admin with filing returns regularly

- Being charged penalties if your GST returns or payments are late

How to register your business for GST

Before you register GST for your business, you’ll need the following information.

- The IRD number of the person/organisation you’re registering

- Your bank account number for your GST refunds

- Your business’ expected turnover in the next 12 months

- Your BIC (Business Industry Classification) code. E.g. clothing retailer, marketing consultant. You can find out your BIC code here.

- Confirm how often you want to file your GST returns (e.g. two-monthly, six-monthly).

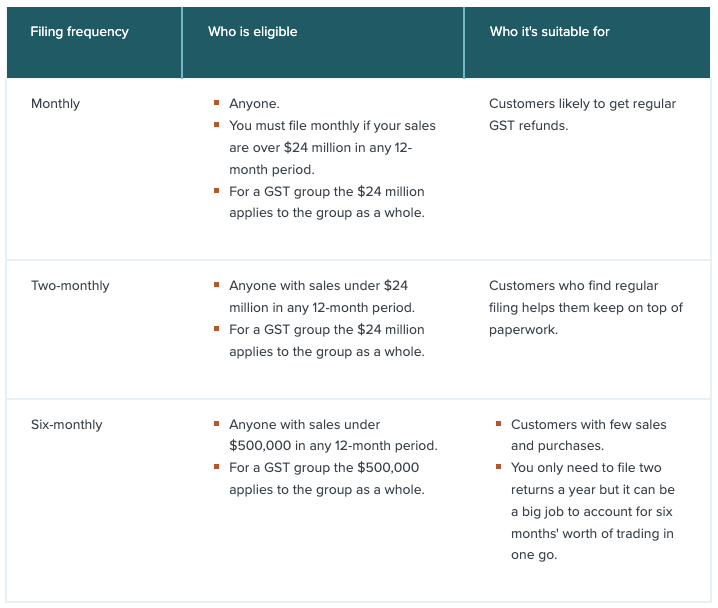

Here’s a guide by IRD on choosing the best filing frequency for you

Confirm your GST accounting basis

Once you register for GST, you’ll need to choose your GST basis. What you choose determines how you account for GST collected from your sales and income – as well as the GST you’ve paid to suppliers and towards expenses. The options are:

- Payment basis – whenever there are payments received into, or paid out from your bank account, your GST is automatically entered into your GST return

- Invoice basis – your GST is evaluated based on the dates of the invoices you send/receive, versus what goes through your bank account

- Hybrid basis – this option follows the payment basis for the bills you pay, and the invoice basis for the bills you send (less commonly used)

Check IRD’s handy online tool to help you decide

the best accounting basis for you.

Invoice requirements when charging GST

Once registered for GST, it’s time to start charging 15% GST on your invoices to your customers. For example, if you’re charging $100 + GST for your goods or services, it should now display $115 total with GST included.

If you don’t add the 15% GST to your customers, you will need to cover this and pay IRD yourself to cover it.Not to worry, most accounting systems, like Xero have easy-to-use templates and the necessary fields available to ensure you capture the information you need when billing your clients.

Checklist of what’s required on your invoice:

- The header ‘Tax invoice’ included

- Your trading business name

- Your business IRD number

- The date of invoice

- The description of what the invoice is for

- The total amount due with GST included/excluded

- The name and address of buyer (if total is over $1,000)

Quantities, with GST exclusive/inclusive amounts for each (if total is over $1,000)

What you can or can’t claim on GST

You can claim GST on most transactions that incur to keep the day-to-day of your business running. The more you can claim, the less tax you need to pay. However, it can be a minefield when you’re starting out – this is when engaging a bookkeeper would be super helpful!

| Expenses you can claim on | Expenses you can’t claim on |

|---|---|

| Rent on business premises Computers and office furniture Software, subscriptions to do your job Work-related mobile phones and phone bills Stationery Work uniforms Tools, equipment to do your job Marketing, advertising costs Vehicle, travel costs Entertainment costs with clients | Clothing for personal use Food, drinks, entertainment for personal use Household items unrelated to home office use Medical expenses and personal care/grooming Insurance on personal assets Loans and penalties |

BONUS: We recently shared a blog on what expenses you can claim when entertaining over the summer period, which is also a superb read – check it out here.

Filing and paying GST

You’ll need to file a GST return for every taxable period using your choice of accounting basis (payment, invoice or hybrid basis) – even if there’s a zero return. You can file your GST return via the IRD portal or through your accounting software, such as Xero. However, you’ll need to ensure your coding is up-to-date, accurate, and you have a clear understanding of what you can/can’t claim.

Check out the steps to file your GST return online here.

Due dates for GST returns

Two Monthly GST

| 28 June | April/May GST Return & Payment Due |

| 28 August | June/July GST Return & Payment Due and 1st Provisional Tax Instalment Due |

| 28 October | August/September GST Return & Payment Due |

| 15 January | October/November GST Return & Payment Due and 2nd Provisional Tax Instalment Due |

| 28 February | December/January GST Return & Payment Due |

| 7 April | Terminal Tax Payment Due |

| 7 May | February/March GST Return & Payment Due and 3rd Provisional Tax Instalment Due |

Six Monthly GST

| 28 October | April/September GST Return & Payment Due and 1st Provisional Tax Instalment |

| 7 April | Terminal Tax Payment Due |

| 7 May | October/March GST Return & Payment Due and 2nd Provisional Tax Instalment Due |

TIP: There are two exceptions with due dates: For the taxable period ending 31 March is due 7 May and the taxable period ending 30 November is due 15 January.

Late penalties

For goods and services tax

Legally, you must file GST tax returns for your business. Failing to do so on time, results in late penalty fees. If you’re on the ‘payment basis’, the late filing penalty is $50. If you’re on the ‘invoice’ or ‘hybrid basis’, the penalty is $250. These are due on the 28th of the month after the return was due.

Exception dates: Where the filing penalty would normally be due on 28th December, it’s due on 15th January and for 28th May, it’s due on the 7th June.

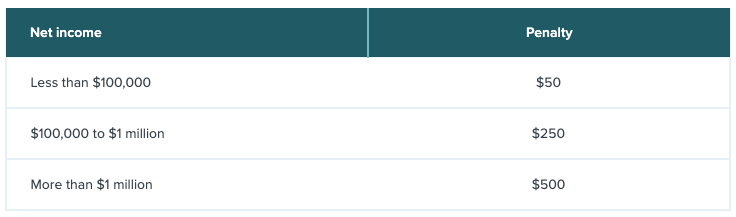

For income tax

The penalty amount on a late income tax return depends on your income. If you haven’t filed your return, the late fee is based on your income in your previous year’s return. If you’ve filed a late return, the penalty fee will adjust for the actual income for the current year.

Here’s a net income and penalty guide by IRD

TIP: There are exceptions with late penalty fees within good reason. Your accounting partner will be able to help advise on this.

Remove the guesswork and reduce your stress levels with the help of a bookkeeper

We hope you’re feeling more clued up with the world of GST after reading this article – or keep it bookmarked so you can keep referring back to it for guidance. If you think you’re at capacity and this all sounds too much – free up your time and hand over the nitty gritty GST work over to Honeybooks. We’re your bookkeeping experts who thrive on numbers, details and streamlining processes.

Wanna chat numbers?

Check out our done-for-you bookkeeping packages, or book a 30-minute discovery call with us so you can free up your time to focus on the bigger picture of your business.

Comments +